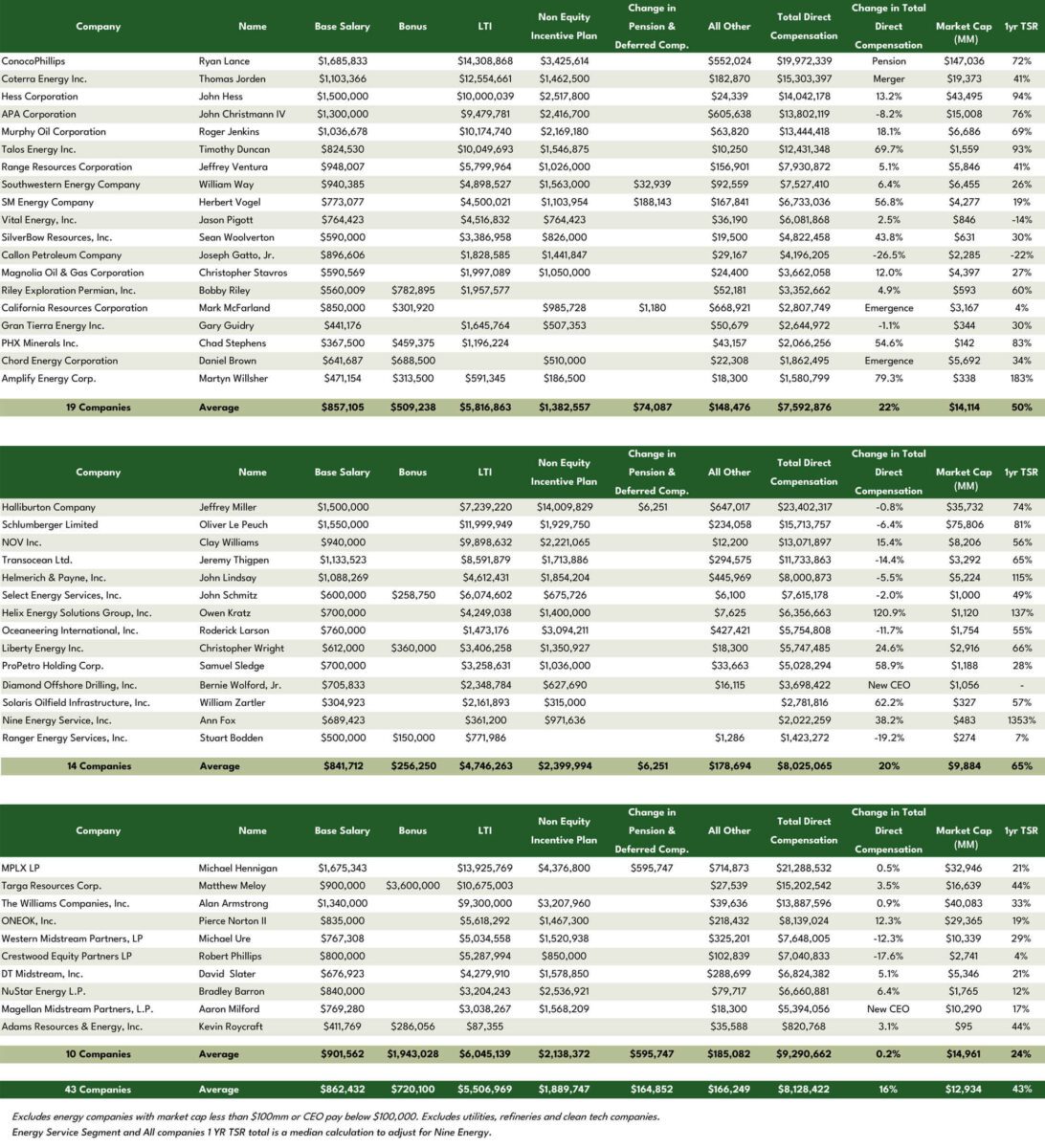

FY 2022 was a great year for energy company employees and investors! Zayla Partners has analyzed the first 43 energy companies (as of April 7, 2023) to file proxy statements or 10ks disclosing executive compensation for FY 2022.

A quick snapshot of Total Shareholder Return (TSR %) and CEO pay as compared to FY 2021 has quantified just how good the year was. While CEO base salaries were up 7% on average, the majority of increases from FY 2021 were in long-term incentives. The base salary increases are consistent with significant employee salary increases experienced in energy companies and the general market in FY 2022 due to hyper-labor tension and hyper-inflation. However, to continue good governance and good pay-for-performance links, energy companies continued to link the majority of CEO pay changes with the shareholder experience.

While the current analysis is a partial picture, the following provides highlights for three energy segments, E&P, Energy Services:

Average TSR

- (19 Cos) E&P TSR +50%

- (14 Cos) Energy Services TSR +65%

- (10 Cos) Midstream TSR +24%

CEO Pay Average Increase

- (19 Cos) E&P CEO pay +22%

- (14 Cos) Energy Services CEO pay +20%

- (10 Cos) Midstream CEO pay +0.2%