For the past 16 years, long-term incentives (LTI) in private companies have significantly increased.

According to WorldatWork, the prevalence of LTIs in private companies increased from 35% in 2007 to 62% in 2019.

Given the current hyper-competitive market combined with volatile macro conditions of 2023 and beyond, the majority of private companies in every US industry are adopting or rethinking their LTI program. From small start-ups to family-owned businesses to large multi-national private companies, each company is thinking through their own unique circumstances, culture and goals to ensure they get the LTI plan design right.

Getting into LTI design mechanics can be tricky territory.

Questions such as:

- Should we use cash or stock in the LTI plan?

- Who do we include in the LTI plan?

- Should we provide interim liquidity or force to hold?

- Should the LTI be performance-based or retention-based?

- Should we allow tax deferral rights?

And the list goes on.

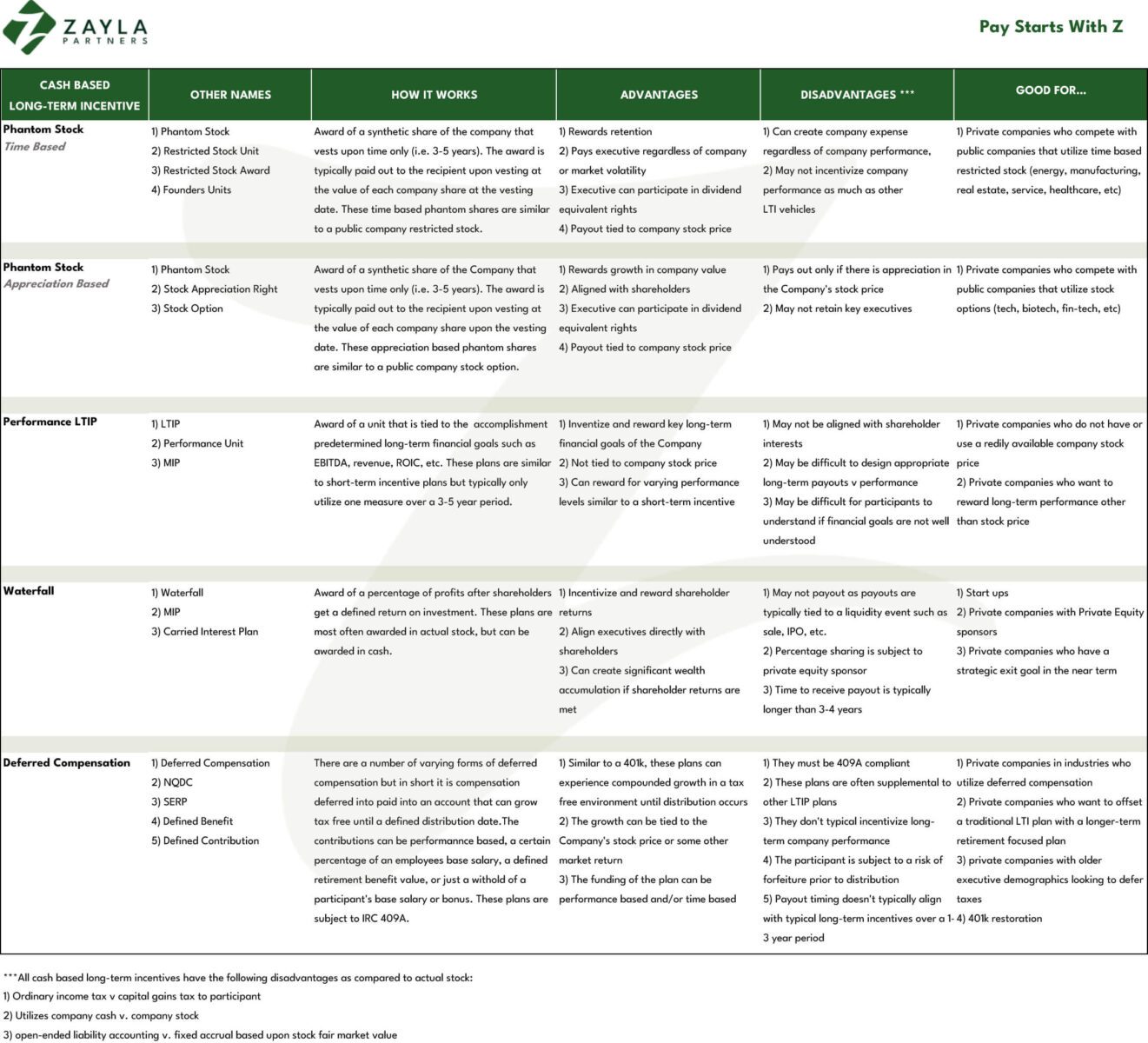

We’ve spent decades assisting WorldatWork and advising clients on LTI plan design with varying book requests on this topic. Consequently, we’ve provided a quick guide for alternatives for a cash-based LTI plan. In the attached chart, we cover what they’re called, what circumstances could work best, how they work, and pros & cons. While this chart won’t be the end-all for cash-based LTI plan design, it must provide a solid foundation to steer some initial decision-making around a critical component of variable pay.

Alternative:

While our team has spent decades advising clients on LTI plan design, we have also been assisting WorldatWork with varying book requests on this very topic. As a result, we have developed a quick guide for cash based LTI plan alternatives. The chart below covers what they are called, how they work, pros & cons and what circumstances work best. This chart is not the end all be all for chas based LTI plan design, but it will provide a solid foundation to steer some initial decision-making around a critical componenet of variable pay.