Heads up! New rules are coming for executive stock sales. The new “companion” rules appear to be changing in tandem due to a recent Wall Street Journal article that uncovered executives who were taking advantage of existing rules to gain advantages on well timed stock sales. One SEC rule change is pending in regard to 10b5-1 plans and one SEC rule change was recently approved for Form 144 filings.

10b5-1 Pending Change

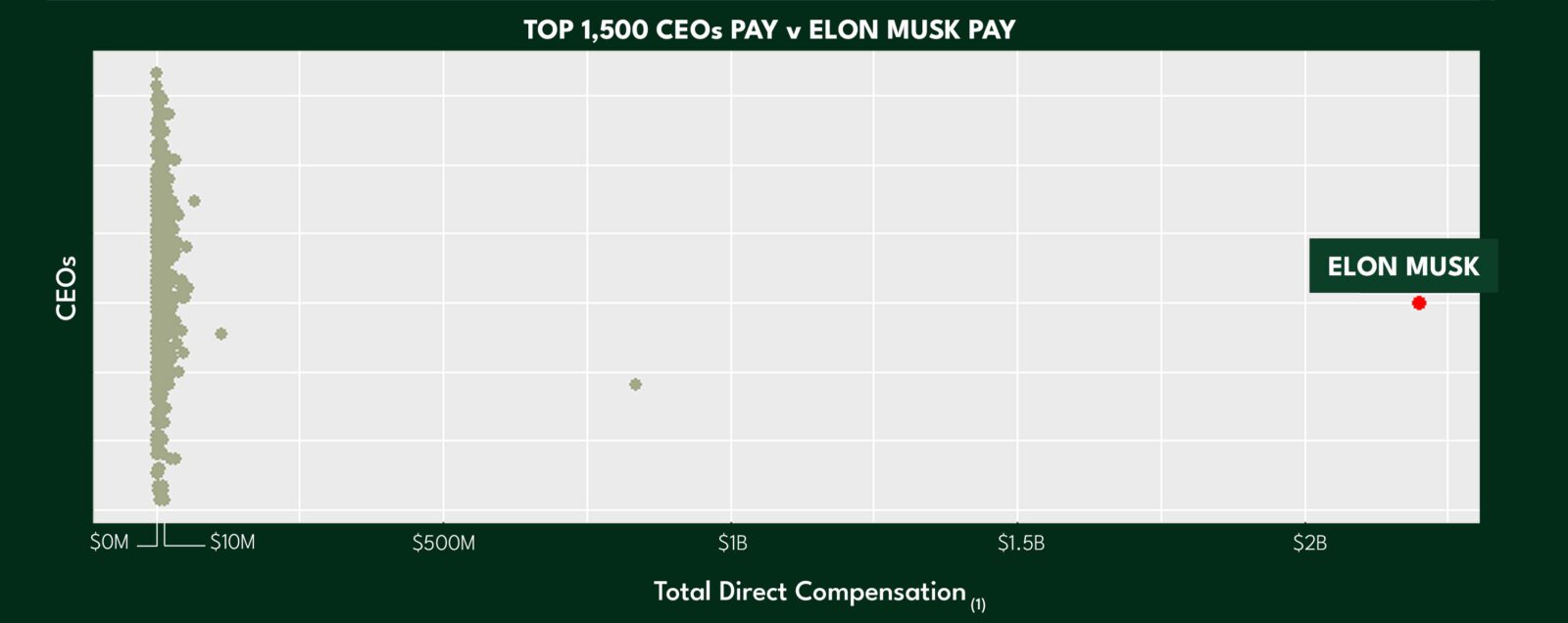

Recently, The Wall Street Journal reported a new compensation study that took up front-page headlines.

The 5-year analysis concludes that approximately 20% of public company insider trades made within 60 days of initiating 10b5-1 programmed stock trading plans gained an additional $500M by virtue of “good timing” ahead of a downturn. We have seen this before. In the past, when the Wall Street Journal analyzed these well-timed CEO stock profits, it usually means accountability and change is coming in the near future.

The SEC apparently knew these early sales were a problem, as they have proposed new rules to revise rules on 10b5-1 plans, including mandatory cooling-off periods after adoption. The Wall Street Journal analysis concluded that about 44% of the early trades reviewed would not have been permitted under the new SEC rules. The SEC has announced April 2023 as the target date for adoption. Below is a summary of the SEC’s proposed rules that will likely become effective next year.

10b5-1 Plan Changes

- two new cooling-off periods—a 120-day cooling-off period after adoption or modification for officers and directors and a 30-day cooling-off period for companies;

- prohibition on multiple overlapping trading arrangements;

10b5-1 Governance Changes

- requirement that Rule 10b5-1 trading arrangements be entered into and operated in good faith;

10b5-1 Disclosure Changes

- written certifications for officers and directors at the time of adoption or modification that they are adopting the plan in good faith are not aware of MNPI about the company or its securities;

- a new checkbox on Section 16 forms to show that the trade was made under a 10b5-1 plan;

- required gift disclosures within two business days;

- narrative disclosure about the company’s stock award policies and practices addressing the timing of grants;

- annual disclosure of insider trading policies and procedures;

- disclosure of whether the company or officers or directors adopted or terminated any contract, instruction or written plan to purchase or sell securities of the company, whether or not under Rule 10b5-1, describing the material terms of those trading arrangements;

- a new table showing grants to NEOs made within 14 days before or after an issuer share repurchase or the filing of a periodic report.

Form 144 Insider Sales Rule Changes

The SEC recently adopted amendments to eliminate the paper filing option of several forms, including Form 144 and annual reports, and to require these forms to be filed electronically through the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

The change will expedite the availability and transmission of the information contained on these forms, eliminate the burden of retrieving paper filings and establish an online repository and database for easy access to anyone.

The amendments include a six-month transition period for compliance, which will not commence for the Form 144 requirement until the date on which the SEC publishes a version of the EDGAR Filing Manual addressing updates for filing Forms 144 electronically on EDGAR.

What is the impact of these two companion SEC Rules?

10b5-1

- Directors should monitor the adoption of 10b5-1 plans, and in particular any early planned stock sales from executives ahead of the SEC’s proposed rule changes.

- Once the SEC adopts these changes, we will notify all companies to ensure they stay in compliance

Form 144

- Switch to Electronic filing ASAP. According to the SEC, of the approximately 30,000 Forms 144 that were filed in calendar year 2021, only 234 (or approximately 1%) were filed electronically on EDGAR. The remaining 99% were filed on paper, or as a PDF via email, which will no longer be permitted under the amended rules.

- Be aware, everyone will see 144 sales immediately. Under the existing rules, paper filings are typically only available for the public to review in person at the SEC; therefore, the information on trading plans and other proposed sales contained on approximately 99% of Forms 144 were mostly unavailable to the public. Under the amended rules, such trading details would immediately become publicly available on EDGAR.

- The SEC is providing filers with a six-month transition period to begin submitting these documents electronically in accordance with the EDGAR Filer Manual. This will likely take effect at the beginning of 2023.