Pay VS Performance Disclosure Rules

The SEC adopted new pay vs performance disclosure rules on August 25.

We have provided commentary on these new rules and in particular, we predict the following may be natural outcomes:

- The new disclosures will take additional time and lengthen disclosures.

- Most companies will likely report the new disclosures in the proxy statement near outstanding equity awards tables, but not the CD&A.

- There will be a renewed emphasis on short and long-term incentive plan design to tighten the link between pay and the three key performance metrics (TSR, net income and other).

- Companies may consider moving the timing of the LTI awards towards the end of the year vs the beginning of the year for a number of reasons, and now including to tighten the link between the summary compensation table and the new pay v performance tables .

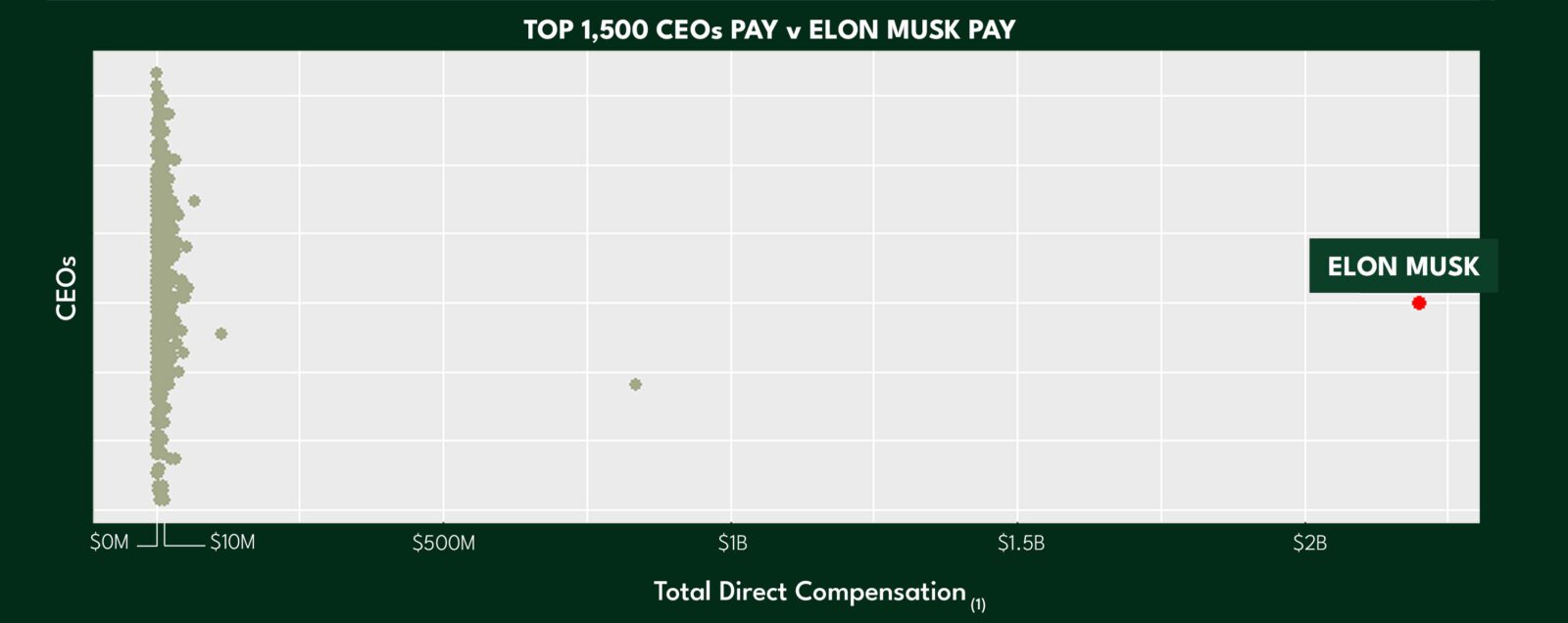

- The potential payout range for executives may grow as top performing companies report top realized pay.

- Media and activist investors will focus more time on the new realized pay numbers, specifically individual companies who have consistent disconnected pay and performance relationships.