“We look for compensation programs that drive sustainable value for a company’s investors in a way that links pay with performance relative to peers.”

This excerpt is from an article published on the Harvard Law School Forum on Corporate Governance by John Galloway, Head of Investment Stewardship at Vanguard, Inc. Given current volatility in the market, this article and the notion that an investment manager with $7.2T in AUM is reminding the public market that it evaluates pay decisions on a basis compared to relevant peers should serve as a good reminder for companies to revisit their peer groups ahead of the fall planning season to ensure they are appropriate and defensible. Given the perpetually increasing scrutiny of executive compensation practices, there are some important elements for companies to consider as they head into the upcoming peer group review process.

Manage Peer Group Volatility

In times of market volatility, companies need to consider that a narrow quantitative approach to peer universe development can lead to considerable turnover in compensation (or performance) peer groups leading to a “shifting of the goal posts” with respect to competitive market compensation benchmarking. The key takeaway here – don’t overreact.

Companies should evaluate potential peers on a multitude of metrics, not simply in isolation on revenue, market capitalization or asset size. If viewed in isolation, particularly in industries that are often assessed on market capitalization, compensation committees might be forced into wholesale changes that would generate considerable challenges downstream when it comes to compensation decision-making.

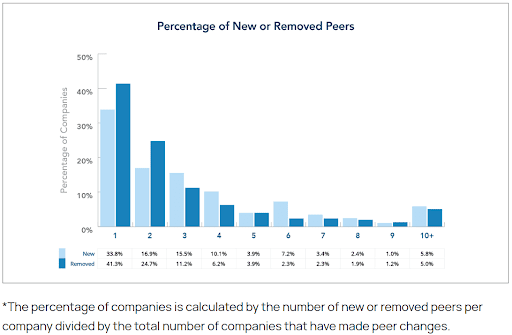

As a general rule of thumb, companies generally try to limit peer group turnover year-over-year to no more than 25% (below image from a 2020 report published by Equilar).

Be Mindful of the Governance Landscape

While their influence may be starting to wane, proxy advisory firms still play a meaningful role in the overall evaluation process of executive and board of director compensation decisions. Institutional Shareholder Services (ISS) and Glass Lewis, the two most influential proxy advisory firms in the US, have their own rigid approaches to creating compensation peer groups.

Compensation committees should be informed of each firm’s methodologies to peer group construction as they do influence external perspectives on executive compensation package decision-making. Further to this, institutional shareholders are increasingly developing their own policies for evaluating pay programs, which include how they establish peer groups for comparisons.

At the end of the day, given all the factors at play, it’s unlikely that a company will select a peer group that aligns perfectly with those of proxy advisory firms or key institutional shareholders, but decent overlap is well within reach.

Clarify Competitors for Talent & Comparisons for Performance Compensation

It is increasingly common in today’s market for a company to have both a compensation peer group and a performance peer group. Tailored compensation peer groups are useful as they assist companies in identifying best-in-class compensation practices in their competitive market for human capital, where those insights are used to develop pay programs that retain and motivate talent to achieve corporate goals and objectives.

Further, well-structured compensation peer groups help protect a company’s reputational capital as they support sound compensation governance and limit scrutiny in the public domain from proxy advisory firms, the media and others. When setting a compensation peer group, consider the following principles:

A compensation peer group should be tailored to a company’s specific industry and size parameters. Note that some industries (e.g. traditional oil and gas) have experienced significant consolidation in recent years, thereby limiting the potential peer universe and making the selection process more challenging.

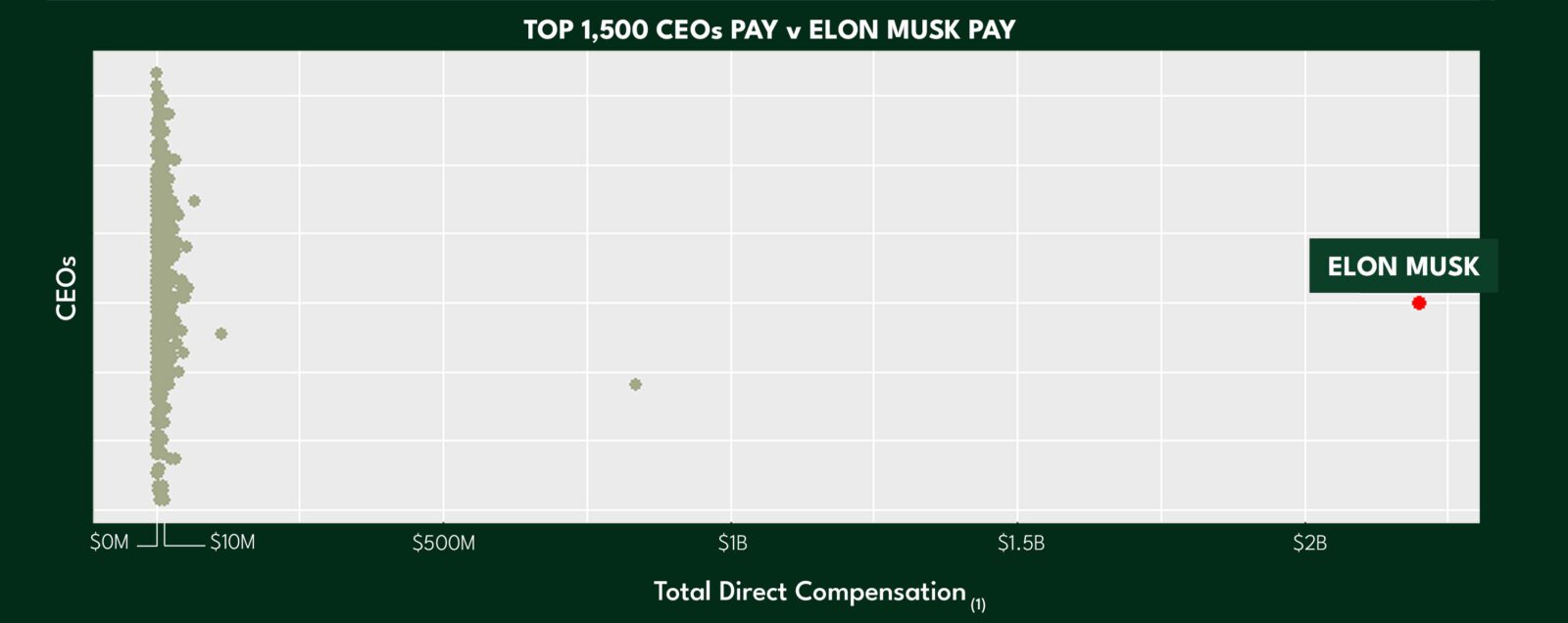

A compensation peer group should be large enough to ensure outlier practices have a muted impact on analytical outcomes. Executive compensation is not a one-size-fits-all world, with numerous examples of companies taking unique approaches to compensating their top talent given extraordinary circumstances. While we support such approaches when done correctly (designing pay with the end in mind), a sufficiently-sized peer group will mitigate the impacts of these practices when companies assess the competitive market.

A compensation peer group should reflect where a company is going over the next year or more, not where it has been. Companies are strategically responding to a multitude of macro events (pandemic, climate concerns, wars, social unrest, market volatility, inflation, etc.) which may result in shifting profiles and footprints going forward. Scrutiny in today’s corporate governance environment means companies need to be mindful of both the content and timing of disclosures around compensation peer groups, so it’s important to consider what the future lens may look like when the external audience assesses your peer group construct. Reminder, most companies have annual meeting dates that result in proxy advisory firms running financial screenings effective December 1st.

If getting the compensation peer group right wasn’t hard enough, companies need to also consider whether a differentiated performance peer group is necessary. Performance peer groups are used only to assess a company’s performance relative to others, often for long-term incentive award calculation purposes. Some principles to consider when determining if and how to construct a performance peer group:

- The approach to establishing the performance peer group is largely similar to that of the compensation peer group, with companies generally focusing on identifying peers within their same industry and size parameters. Note that there are many examples in the market of companies that use the exact same peer group for both compensation and performance peer groups.

- However, since performance peer groups don’t impact the quantum of pay opportunity like the compensation peer group does, it’s more common to find companies developing performance peer groups that consist of additional peer companies beyond the compensation peer group. The reason being that investors view companies across an industry (or relevant index) with the same performance lens when identifying top (or laggard) performers. Many times, performance peer groups include companies that fall outside typical size criteria for compensation peer groups, and they may also be in tangential industries.

- Performance peer groups tend to be larger in size as they have to withstand multi-year performance periods which often include M&A events.

Summary Considerations

Few topics get as much attention as peer group selection. After decades of navigating this process, here are a few concluding considerations:

Where the company is now does not necessarily indicate where it is going. If the company is small to medium-sized but has strong financials and lots of growth projected, it may make sense to think about where the company will be in 12-24 months to capture the most accurate comparisons for attraction, retention and motivation.

Compensation peer groups are not the same throughout the organization. Executive peers tend to correlate based upon financial size and industry. However, employees below the executive ranks do not have the same tight correlation and thus different metrics of size, industry and geography are utilized to determine the right comparisons.

Include all stakeholders early. There are lots of opinions on what is the correct peer group and challenges occur when only 1 view is taken into account to determine the peer group.

Consider compensation philosophies when determining the right peer group. Company compensation philosophies vary greatly and should be considered when determining an appropriate peer group. Note that this means evaluating your own internal philosophy as well as those of potential comparators.

Utilize multiple sources to create a robust market compensation analysis. While publicly traded data provides specific insight to individual companies and their top five executives, additional data sources should be considered (e.g. published survey data).

Peer group analyses are just that – informative data. There are many inputs into final decision making for compensation changes. Some of these include: compensation philosophy, company performance, individual performance, tenure, macro trends on supply and demand of labor, economic outlook, historical compensation practices, etc. Peer group comparisons should be viewed as just one of many factors influencing final pay decisions.